For a supposedly mythical creature, unicorns seem to be remarkably plentiful these days. In the San Francisco Bay Area alone there are, by our count, 174 of them.

Of course, unlike the single-horned creature popular in ancient Chinese and Indian myth, the companies we’re talking about are very real, and multiplying.

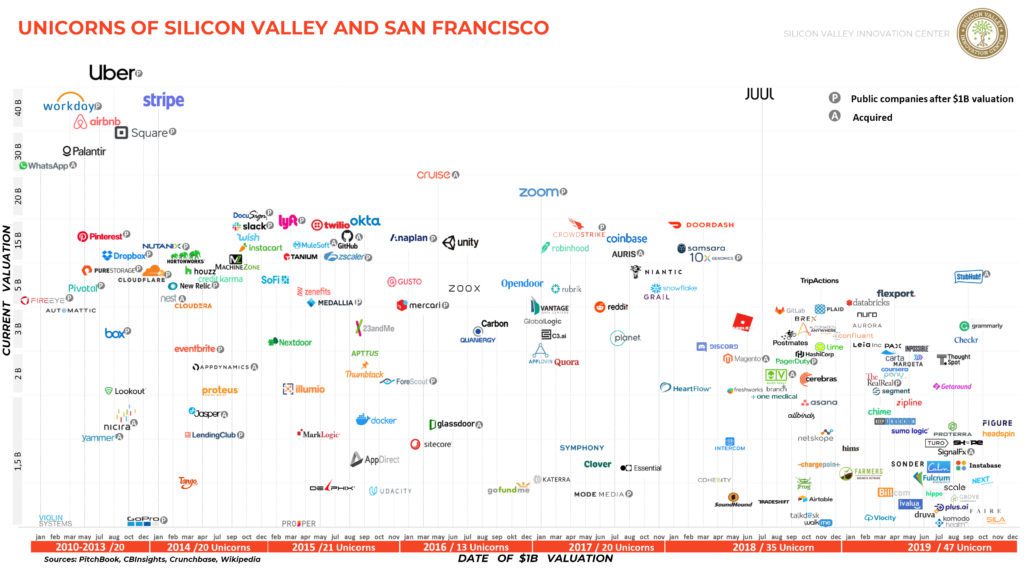

Just how numerous they are is shown in the infographic below, which provides a bird’s-eye view of companies in Silicon Valley valued at $1 billion – the magical number that confers unicorn status – or more:

A population growing and migrating

What do we see? There are multitudinous ways to interpret the data, but perhaps most impressive is the tight cluster of companies on the bottom right of the picture. This grouping tells us that 2019 was a bumper year for unicorns: barely a month passed without at least one startup joining the club.

It’s a trend that looks set to continue. Already in 2020, we have seen several privately held companies valued at $1 billion or more, including two in the Bay Area. But while Silicon Valley may be the historic home of the tech unicorn, it is no longer their sole habitat. The U.S. and China are where the vast majority of big-money startups are located, but India, the U.K., and Germany are also home to contingents of modest size.

Globally, there currently about 600 unicorn companies and that number are expected to grow. Many analysts believe we are in a golden age of billion-dollar startups, thanks in part to an explosion in recent years in the number of companies being founded generally. These early-stage ventures are fuelled by a growing pot of capital; the data show that the amount of money flowing into startups has increased steadily year-on-year for the last decade.

Out with the old…

Yet just as new players regularly enter the ranks of the unicorns, so too do veterans of the category depart. We’ve indicated as much on our graphic, with the “P” next to the likes of Lyft, Slack, and Docusign indicating the transition they’ve made from the multi-billion-dollar privately held company to publicly traded corporation. Others will be making that same journey later this year, most notably Airbnb. The accommodation rental platform, now in its twelfth year of operation, is valued at around $31 billion. But many analysts suspect that just as with other well-known tech companies before it, Airbnb’s worth will take a tumble when it goes public.

Unicorn status, then, maybe nice to have but it is certainly not an iron-clad guarantee of future success. To put things in perspective, the ‘big four’ technology firms – Apple, Amazon, Microsoft and Google parent Alphabet – are all worth at least one thousand times more than a billion-dollar company. How did they get those three extra zeroes at the end of their valuations? Certainly not by doing just one thing and doing it well, like most of the unicorns in our infographic. On the contrary, they have all had to grow well beyond their original mission.

Can today’s crop of high-flying startups do the same? Perhaps for starters, they should try to turn a profit. When that’s under control, they might move on to thinking about how they’ll respond to disruption, experiment with new business models, and pivot into new markets. Possession of those capabilities, as the big four demonstrate, is the hallmark of successful companies in today’s world.

Finding the right response to industry disruptors

In all the excitement over the new, it’s easy to forget that industry incumbents remain just that – incumbent. Their positions, though indeed threatened by startups, enjoy their own advantages, possession of a wealth of historical consumer data not least among them. Yet even to define the relationship between early-stage and mature businesses in this way – by default as one of conflict – obscures a more complex truth: collaboration, not a competition, is, as it always has been, the more powerful engine of growth and progress. Find out how we can help your company engage with the world’s most innovative startups.