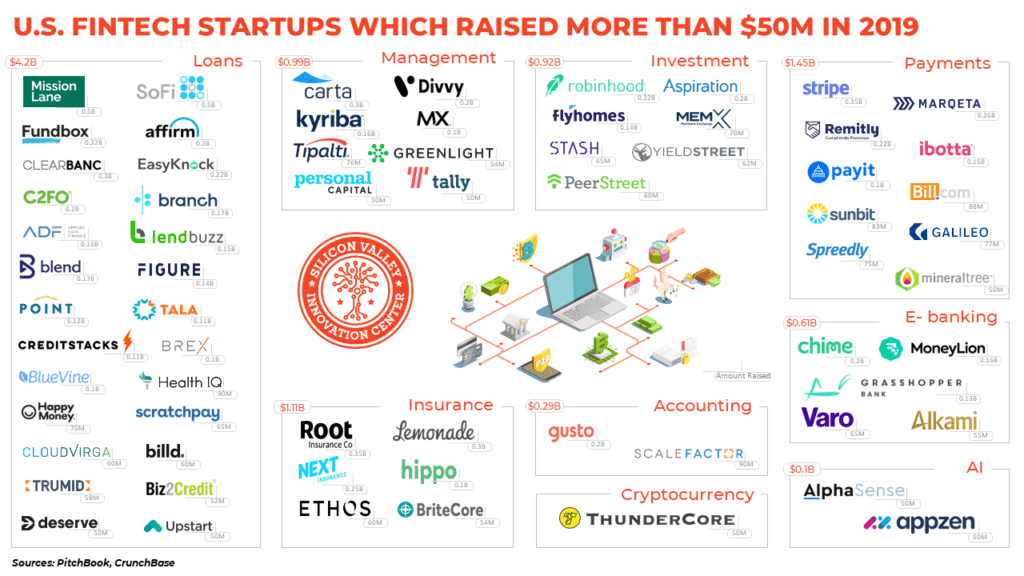

It is often said in finance that past performance is no indication of future success but in the case of the fintech sector we might justifiably wonder. Surely any company that can raise $50 million in investment in a single year, as the ones we present in this infographic have done, has a bright future ahead of it?:

Take, for example, Robinhood, in the investment category. Since its founding in 2013 the company has raised some $900 million in total funding, gained 10 million customers in its home market of the U.S. and is about to launch in the U.K., where 60,000 are people are already on the waiting list. Those numbers are undoubtedly impressive but even more admirable is the effect Robinhood has had on financial services more generally. Its offer to consumers of commission-free stock trading has now been copied by several incumbent brokerage firms, rendering declarations that Robinhood is an industry disruptor and pioneer all the more appropriate.

Breaking the mold

We see this same pattern repeating itself across multiple sub-fields of banking and finance. Lemonade, a new-wave insurer, is a case in point. Just like Robinhood, the five-year-old outfit is exclusively digital, well-capitalized and recently expanded beyond its home market. What’s more, the two startups both appeal to the millennial generation and are even members of the same club: the ‘unicorn’ club of privately held companies valued at more than $1 billion.

This same success story can be told for more or less any of the companies featured in our fintech sector infographic. The flip side of that coin, however, is that if these startups wish to grow into fully fledged public corporations (and that’s a big ‘if’), they must all conquer a similar set of challenges. Chief among them is long-term profitability, something which, as we’ve seen in recent months with big-name tech IPOs, is not to be taken for granted.

Yet those big names, such as Uber, Lyft and Slack, may still come good. If they do, that would be cause for optimism for the fate of the 67 fintechs we’ve highlighted here. All of them shine brightly today, but how many will still be with us in five or ten years’ time? Let’s check in again then. That’s when we’ll be able to look back on the current moment and answer the question: “was past performance an indicator of future success?”

Finding the right response to industry disruptors

In all the excitement over the new, it’s easy to forget that industry incumbents remain just that – incumbent. Their positions, though indeed threatened by startups, enjoy their own advantages, possession of a wealth of historical consumer data not least among them. Yet even to define the relationship between early-stage and mature businesses in this way – by default as one of conflict – obscures a more complex truth: collaboration, not competition, is, as it always has been, the more powerful engine of growth and progress. Find out how we can help your company engage with the world’s most innovative startups.