“A million dollars isn’t cool. You know what’s cool? A billion dollars.”

So says Justin Timberlake as Sean Parker, Facebook’s first president, in the 2010 film The Social Network. Today, with an astonishing $595 billion valuation, Facebook has gone well past cool — take that as you will — and proved beyond a doubt that digital platforms have remarkable potential. Over the past decade and a half, Silicon Valley startups and established companies alike have chased this potential in every market segment imaginable. They’ve made the bet that platformification— the shift to open, digital ecosystems — is the future of business.

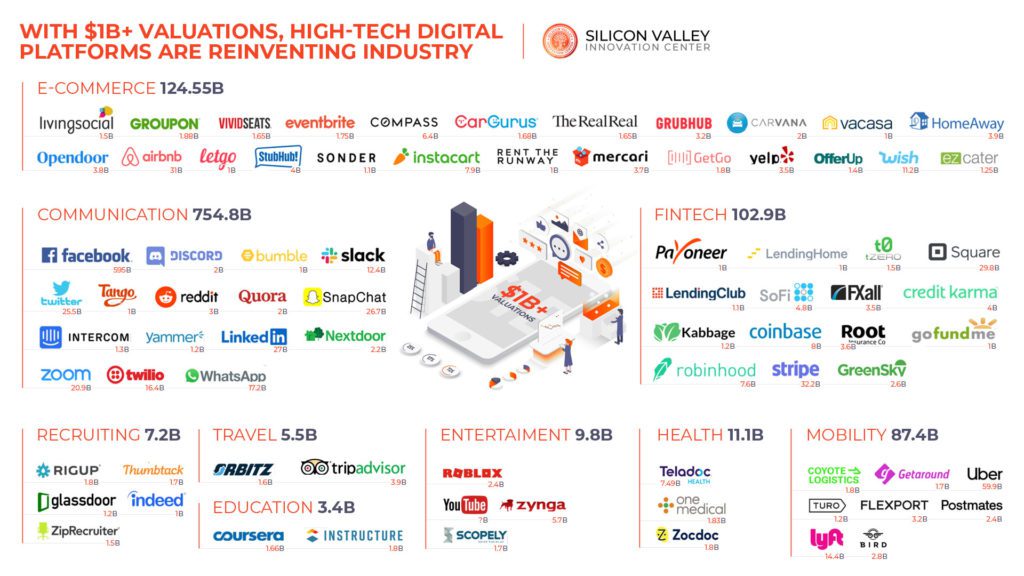

As seen in our infographic above of 87 high-value platforms, this bet has begun to pay off. In other words, these companies and their investors know what’s cool.

But just where do these billion dollar valuations come from? Take a look at Square, in the FinTech sector, a popular digital payments platform known for their square-shaped credit card readers. Square began in 2009 by providing a simple, scalable payment system for small businesses. Their flagship card-reading tech, which plugs into any seller’s smartphone, is more than accessible: Square gives it away for free. The company offers a point of sale app alongside these readers, and doesn’t need to worry about who’s selling, who’s buying, or what’s being exchanged. All Square has to do is run the overall business ecosystem, and if they do this well, the market takes care of the rest. This is the power of platformization, and Square has followed up its initial success with forays into food delivery platforms, website-building platforms, and a thriving peer-to-peer payments and investments app.

Despite this success, Square’s stock is no doubt overpriced. In 2019, the company had just $374.5 million in annual profit to show for their $29.8 billion valuation; that’s a price to earnings ratio of almost 80 (meaning the company will deliver $1 in earnings for every $80 invested). What makes Square’s business model, and indeed any digital platform, so much more valuable than the raw numbers suggest?

The power of platforms

The continuous advancement of technology, rise of internet-savvy consumers, and accumulation of data has created a radical shift in the ways we live and do business — more radical, perhaps, than any change that has come before. Digital platforms are not only made possible by this current era but are an exceptionally appealing business model within it. Let us count the ways:

- Low cost to entry, low overhead. Though costs obviously differ from company to company (the shared scooter platform Bird, for example, must maintain its fleet of e-scooters), digital platforms in general avoid the high startup and operating costs of physical businesses.

- Efficient. Natural market forces are the backbone of digital platforms, which connect pools of individual providers and users. Take a company like Uber, the defining ride-sharing platform, which automatically adjusts prices based on demand. This, in turn, balances the number of drivers (providers) and riders (users) until an optimum is reached.

- Trivial to scale. Unlike traditional, physical businesses, many digital platforms can grow in size dynamically to meet demand — and expand to new markets with the click of a button.

- Widely applicable. Every market segment has the potential for some degree of platformization, and the model can be customized to match the niche: digital platforms can take the form of software as a service (SaaS), B2B2C models, peer-to-peer transactions, and more.

Savvy investors see the long-term wealth potential in platforms — the numbers in our infographic speak for themselves. Though not all these billion dollar companies are bound to succeed, the digital business models they’re based on are certainly here to stay.

Virtual ecosystems, real wealth

In a recent presentation to executives visiting Silicon Valley Innovation Center, one top-level Digital Platforms Consultant asserted that all business ecosystems are becoming virtual. If this can be seen in industries as traditional as healthcare (see Zocdoc, a medical appointment booking platform) and real estate (check out Airbnb, the well-known peer-to-peer hospitality platform), it may be a safe bet.

Take another traditional industry: higher education, established over two thousand years ago. Coursera, launched just eight years ago, is an online learning platform that offers courses from hundreds of universities, colleges, and corporations across the world. By partnering with top universities to award real degrees, Coursera’s business model combines the efficiencies of digital platforms with the trustworthiness (and value therein) of established higher education institutes.

As traditional industries continue to trend virtual, the potential for growth, innovation, and platformization only expands. New data, new technology, and new partnerships can always be leveraged to gain a competitive edge, both in established markets and in those yet to be created. Consider, as an example, the creation of bitcoin and blockchain technology in 2008. Just over a decade later, cryptocurrency exchange platforms like tZERO and Coinbase have turned this invention into billion dollar companies backed by some of the world’s biggest investors.

Transitioning from traditional models to digital platforms

Digital platforms may have a low cost of entry, but being able to start a business with ease does not make starting a billion-dollar business easy. Platforms achieve success through a positive feedback loop: a high quality service leads to more users, leading to increased demand, leading to more competitive providers, leading back to higher quality service, and so on.

Bootstrapping this feedback loop to gain a foothold in the market is far from trivial, and here industry incumbents have a clear leg up. Established companies with a trustworthy brand, large customer base, and well-oiled business ecosystems can leverage these assets when experimenting with platformification. And this does not have to mean a fast, singular, or even complete transformation before the benefits of platform-based models can be seen. Instead, incumbents can test the waters with MVPs based on their existing businesses or partner with leaner startups who have the tech but not the ecosystem to back it up. Discover how we can help your company work with some of the most innovative startups and digital platforms in Silicon Valley.