Winning with Purpose: a Comprehensive Guide to Implementing ESG in Your Organization

Introduction

How can businesses navigate market disruptions without compromising their values or profitability? This question lies at the heart of modern business challenges. Market disruptions, such as economic volatility, technological advancements, and shifting consumer behaviors, often force companies to make hard decisions that test their commitment to core principles. For instance, a sudden supply chain disruption might compel a company to choose between sourcing ethically or meeting production deadlines at any cost.

The rise of Environmental, Social, and Governance (ESG) principles has added another layer of complexity. With escalating consumer expectations, stringent regulations, and an increasingly competitive landscape, ESG has shifted from being an optional ideal to an essential imperative for organizations seeking resilience and relevance.

In this guide, we will provide a step-by-step approach for organizations to effectively implement ESG principles—even those in industries with controversial products.

Let’s explore the potential future where ESG becomes a universal business necessity.

Understanding ESG and Its Importance

What is ESG?

ESG stands for Environmental, Social, and Governance, which are three key areas that show how a company operates responsibly and sustainably.

- Environmental: How a company impacts the planet, like reducing pollution, managing waste, or using renewable energy.

- Social: How a company treats people, including employees, customers, and the communities it affects, focusing on fairness, safety, and positive relationships.

- Governance: How a company is run, ensuring ethical practices, transparency, and accountability in decision-making.

In simple terms, ESG is about businesses doing what’s good for the planet, people, and society while staying fair and ethical.

Why ESG Matters

The significance of ESG lies in its ability to create a sustainable framework for businesses, ensuring long-term resilience and relevance.

Regulatory Drivers such as the EU’s CSRD or the SEC’s proposed climate disclosure rules. These policies don’t just enforce compliance; they compel businesses to rethink their operational and strategic priorities to remain viable. For example, failure to disclose emissions data could lead to penalties and reputational damage.

Investor Demand adds another dimension. ESG-aligned companies often gain preferential access to capital, as investors increasingly seek organizations with robust sustainability and governance practices. A company embracing ESG can attract not only investments but also top-tier talent, with purpose-driven employees prioritizing organizations aligned with their values.

On the consumer front, brand loyalty now hinges on shared values, with sustainability becoming a significant driver of purchasing decisions. Recent studies indicate that consumers are increasingly willing to pay a premium for sustainable products. For instance, a PwC survey found that more than four-fifths (80%) of consumers are willing to pay more for sustainably produced or sourced goods, with an average premium of 9.7%.

Patagonia’s commitment to sustainability has significantly contributed to its financial success. The company has experienced substantial growth, with sales quadrupling over the past decade to around $1 billion annually. This growth is attributed to Patagonia’s sustainable business practices, which have resonated with environmentally conscious consumers. By integrating sustainability into its core operations, Patagonia has not only enhanced its brand reputation but also achieved remarkable sales growth, demonstrating that a strong commitment to ESG principles can lead to increased profitability.

Risk Mitigation also comes into play. In theory, ESG reduces exposure to disruptions by fostering robust operational practices and compliance frameworks. For example, organizations that prioritize environmental sustainability often implement resource efficiency measures, such as diversifying energy sources or using renewable materials, which can safeguard against supply chain interruptions caused by resource scarcity or geopolitical conflicts. Social initiatives, like promoting fair labor practices across the supply chain, may help prevent strikes, lawsuits, or ethical scandals.

However, in practice, implementing ESG principles is a complex and effort-intensive process. Even prominent brands occasionally falter in execution. For instance, Unilever, despite being a leader in sustainability, faced criticism for overestimating the holistic success of its ESG efforts. The company scaled back some initiatives after encountering operational challenges and skepticism about their measurable impact on growth. This underscores that while ESG offers a strong theoretical foundation for resilience, its practical application requires careful planning, consistent execution, and adaptability to avoid pitfalls.

Is ESG a Necessity for All Businesses?

It would be technically incorrect to claim that ESG is currently a necessity for all businesses, as it is not universally enforced, particularly for medium and small enterprises. However, as ESG increasingly becomes a focal point for regulators, investors, and consumers, understanding its current landscape and anticipating future developments is crucial. Let’s delve into the present requirements and explore what businesses can expect in the near future.

Regulatory Compliance and Market Trends

Regulatory compliance for ESG varies widely across regions and business sizes, but its impacts are increasingly tangible. For example, the European Union’s Corporate Sustainability Reporting Directive (CSRD) mandates that large public companies disclose extensive non-financial information, pushing them to adopt ESG-aligned practices or face penalties. In the United States, the SEC’s proposed climate disclosure rules would require listed companies to report their climate-related risks and emissions data, a move aimed at fostering transparency and accountability.

For small and medium-sized enterprises (SMEs), while direct regulatory requirements are often absent, indirect pressures emerge. SMEs frequently operate within larger supply chains where compliance is expected. For instance, a supplier to an automotive giant may need to meet the manufacturer’s ESG criteria to maintain the partnership.

These regulations drive businesses to adapt, regardless of size. Large corporations allocate dedicated teams to ensure compliance, often investing in technology like ESG reporting software. SMEs, constrained by resources, may focus on incremental improvements, such as energy-efficient operations or sustainable sourcing, as practical entry points into ESG adherence.

The Growing Mandate

Global regulatory frameworks for ESG are rapidly evolving, and within the next two decades, these expectations are likely to impact every industry. While adopting ESG practices can be challenging and the financial benefits are not always guaranteed, businesses that fail to adapt risk falling behind in a market increasingly shaped by conscious consumers and investors. Implementing ESG effectively is challenging, but ignoring it is increasingly counterproductive as stakeholder expectations and regulatory pressures continue to mount.

We will later explore strategies to help you implement ESG initiatives while minimizing financial risks for your organisation.

ESG for Controversial Products

Industries such as tobacco or gambling face intense scrutiny, complicating ESG implementation. To navigate these challenges, prioritize harm-reduction initiatives, such as developing safer alternatives, alongside sustainability efforts and impactful social outreach programs. These actions can help build credibility and mitigate negative perceptions.

Environmental Efforts: Companies can prioritize sustainable sourcing, reduce waste, and minimize their carbon footprint. For instance, Diageo’s development of paper-based bottles is a noteworthy step toward reducing environmental impact in the alcohol industry.

Social Impact: These industries must proactively address societal concerns. Awareness campaigns promoting responsible consumption are critical. British American Tobacco’s investment in community farming initiatives is an example of fostering social goodwill.

Governance Practices: Adopting stringent anti-corruption measures, ensuring compliance with advertising standards, and focusing on harm reduction showcase how controversial industries can align with ESG goals.

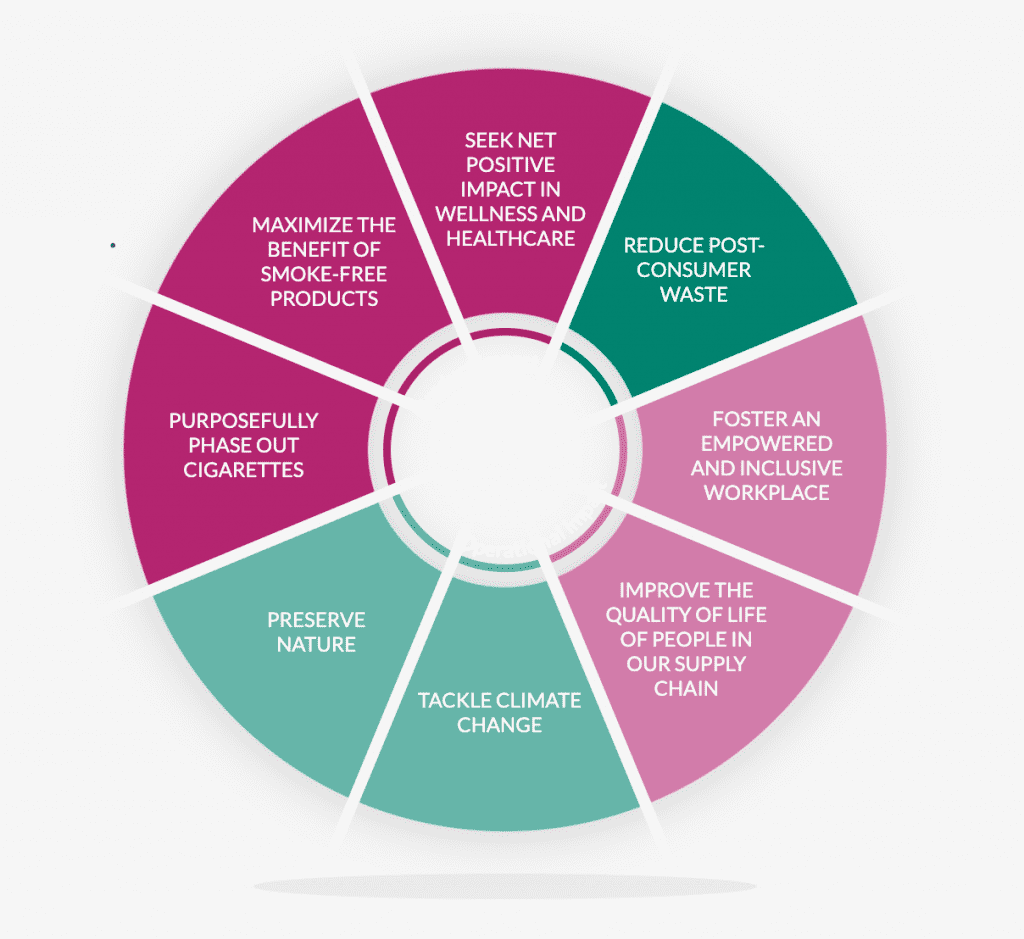

Philip Morris invested heavily in research and development to create smokeless products as part of its “smoke-free future” initiative. Their ESG framework distinguishes between “Product Impact,” addressing the societal effects of products through innovation and growth opportunities, and “Operational Impact,” focusing on responsible management of social and environmental practices across their value chain.

Image source: Philip Morris International website

This pivot demonstrates a commitment to addressing societal health concerns while maintaining market relevance.

Step-by-Step Guide to Implementing ESG

Implementing ESG requires a structured approach that integrates sustainability principles into every facet of the business while ensuring that the organization’s bottom line is not negatively impacted:

- Set Clear Objectives

Engage leadership to champion ESG principles and secure buy-in. Develop actionable, measurable goals. For example, an e-commerce company might aim to reduce packaging waste by 30% within three years.

- Conduct an ESG Audit

Evaluate current policies and practices against established frameworks like GRI or SASB. Involve stakeholders through surveys or focus groups to identify areas for improvement.

- Develop an ESG Strategy

Align ESG objectives with broader business goals. For example, prioritize renewable energy if it aligns with operational cost reductions. Define clear KPIs such as emission reductions, employee retention rates, or supplier compliance metrics.

- Create Policies and Programs

Develop policies tailored to the business’s unique ESG challenges. Examples include anti-corruption policies or diversity hiring initiatives. Launch programs like tree-planting campaigns or community outreach projects to align actions with stated objectives.

- Embed ESG Across Operations

Ensure ESG principles permeate all departments. HR might lead diversity and inclusion initiatives, while operations focus on energy efficiency. Collaborate with suppliers to achieve shared ESG goals, such as reducing waste in the supply chain.

- Leverage Technology

Use tools like AI to optimize energy consumption or blockchain to ensure supply chain transparency. These technologies streamline reporting and enhance accountability.

- Build a Collaborative Culture

Train employees on ESG priorities and encourage their participation through workshops and incentive programs. Foster a culture where ESG is part of everyday decision-making.

- Collaborate and Partner

Partner with organizations such as NGOs or join initiatives like the UN Global Compact to share knowledge and resources. Collaborations amplify impact and demonstrate commitment to broader sustainability goals.

- Report Progress

Use established frameworks to create ESG reports that highlight achievements and identify areas for improvement. Share these reports transparently with stakeholders, building trust and accountability.

- Continuously Improve

ESG is a dynamic process. Regularly review goals in response to stakeholder feedback and emerging trends. Benchmark performance against industry peers to stay competitive and adapt to new challenges.

Challenges and Solutions

Implementing ESG comes with hurdles that businesses must strategically navigate. Below are common challenges and actionable solutions:

Cost of Implementation:

Many organizations view ESG initiatives as costly due to the initial investments required for technology, training, or sustainable materials. To offset these expenses, prioritize initiatives with the highest return on investment (ROI), such as energy-efficient systems that deliver significant long-term savings. Additionally, consider leveraging green funding options like government subsidies, ESG-linked loans, or collaborations with investors who prioritize sustainability.

Resistance to Change:

Employees and leadership may resist changes, often due to concerns about complexity or perceived misalignment with existing goals. To address this challenge, cultivate leadership commitment by demonstrating how ESG initiatives align with business objectives and drive long-term benefits. Foster employee engagement through interactive workshops, transparent communication, and incentive programs that embed ESG principles into the company culture, making it a shared vision rather than an external mandate.

Measuring Impact:

Quantifying ESG outcomes can be challenging without clear metrics or robust systems in place. To overcome this, utilize advanced tools like AI-driven data analytics to gather and analyze relevant information. Adopt established frameworks such as SASB or GRI to define and track key performance indicators (KPIs). Additionally, benchmarking against industry peers can offer valuable insights into your organization’s progress and performance, ensuring alignment with best practices.

Conclusion

ESG is no longer a “good-to-have” initiative but a necessity for businesses across all industries—even those facing unique challenges. By conducting an audit, setting clear goals, and integrating ESG across operations, organizations can position themselves for long-term success.

Begin your ESG journey today, not just as a compliance measure but as a strategic path to resilience and growth. Silicon Valley Innovation Center (SVIC) can help your organization implement ESG with minimal risks by adopting a tailored approach. This includes identifying key ESG priorities, aligning them with your business and financial goals, and leveraging advanced technologies and industry partnerships to ensure seamless execution.