Sustainability Trends and ESG: Transforming Global Commodity Markets

The global economy is undergoing a seismic shift as sustainability and ESG (Environmental, Social, and Governance) principles take center stage, redefining the rules of success across industries. With ESG assets expected to surpass $40 trillion by 2030, the pressure is mounting for businesses to not only comply with stringent regulations but also seize the opportunities presented by a greener future. For the commodity sector, this transformation is both a challenge and a catalyst for innovation.

From decarbonization strategies to the rapid adoption of electric vehicles and green hydrogen, the race toward a sustainable economy is reshaping market dynamics. This article delves into how these forces are transforming global commodity markets, providing actionable insights for companies ready to lead in this new era of resilience, competitiveness, and growth.

Green Energy Transition and ESG: The Catalysts Driving Change

The shift toward a sustainable future is driven by a commitment to reducing carbon footprints and the increasing integration of ESG standards. These two forces—decarbonization and ESG adherence—are reshaping industries worldwide, propelling transformative practices and redefining success metrics. Let’s dive into the global strategies enabling this change, beginning with the critical role of decarbonization in the journey toward cleaner energy.

The Global Push for Decarbonization

The global drive to reduce carbon emissions has gained unprecedented momentum, with countries and industries prioritizing initiatives to transition towards cleaner energy sources. Decarbonization is central to climate action, and various strategies are employed to achieve net-zero goals. Key initiatives driving this ongoing transformation include:

- Expansion of Renewable Energy and Phasing Out Fossil Fuels: The adoption of solar, wind, and other renewable energy sources is accelerating, while reliance on coal, oil, and gas for energy generation is being reduced. Notably, global solar capacity has reached a record 2 terawatts, with more additions in the last two years than in the previous sixty-eight years combined.

- Electrification of Transport: The adoption of electric vehicles (EVs) is accelerating, and investments in EV infrastructure continue to increase to reduce emissions from transportation. In 2023, nearly one in five cars sold globally was electric, with sales nearing 14 million, a 35% increase from the previous year. According to the International Energy Agency (IEA). By 2030, the IEA projects that 60% of new car sales globally could be electric if policies and investments continue to support this shift, marking a significant step towards reducing global carbon emissions and advancing sustainable mobility.

- Carbon Pricing Mechanisms: Carbon pricing mechanisms are policy tools designed to reduce greenhouse gas emissions by assigning a monetary cost to emitting carbon dioxide (CO₂). The primary methods include carbon taxes and emissions trading systems (ETS).

Carbon Taxes: Governments impose a direct fee on the carbon content of fossil fuels, providing a clear economic signal to emitters to reduce their carbon footprint.

Emissions Trading Systems (ETS): Also known as cap-and-trade systems, ETS set a cap on total emissions and allow companies to buy and sell emission allowances, incentivizing reductions where they are most cost-effective.

As of April 1, 2024, there are 75 carbon pricing mechanisms in operation worldwide, comprising 39 carbon tax initiatives. Carbon prices vary significantly across regions, with rates ranging from less than $10 per metric ton in some jurisdictions to over $130 in others, such as Sweden, which leads with a carbon tax of approximately $137 per metric ton. This prompts industries to transition to cleaner technologies.

- Development of Green Hydrogen: Green hydrogen, produced using renewable energy sources, is emerging as a critical zero-emission fuel for heavy transport, industrial sectors, and energy storage. The European Union has set an ambitious target to produce 10 million tons of green hydrogen annually by 2030, with plans to import an additional 10 million tons to meet growing demand. This is part of a global trend where investment in green hydrogen has reached record levels, with major projects underway in regions like the Middle East and Australia.

ESG Standards as a Market Imperative

The importance of sustainable practices and ESG standards has grown significantly, with businesses recognizing their critical role in long-term success. Beyond meeting regulatory requirements, integrating ESG principles helps companies improve operational efficiency, attract investment, and mitigate risks. As consumer and investor demand for sustainable practices rises, companies that embrace ESG strategies are better positioned to thrive in an increasingly competitive market.

The World Economic Forum’s Global Competitiveness Index (GCI) emphasizes that the green transition and adherence to ESG standards are essential for driving long-term productivity growth. ESG alignment boosts resilience and fosters innovation, making it a key factor in maintaining a competitive edge.

Key ESG Initiatives are:

- Environmental Sustainability: Companies are increasingly adopting strategies to reduce environmental impact through enhanced energy efficiency, waste reduction, and resource conservation. For instance, Coca-Cola aims to make 100% of its packaging recyclable by 2025 while committing to use 50% recycled materials by 2030. In addition, its ambitious 2030 Water Security Strategy focuses on improving access to clean water in water-stressed regions, contributing to its net-zero emissions goal. This trend is accelerating as organizations strive to align with global climate goals, such as the European Union’s Green Deal and the U.N.’s sustainable development targets.

- Social Responsibility: There is a growing emphasis on improving labor practices, engaging with communities, and ensuring fair treatment of all stakeholders. Companies like Unilever prioritize inclusive practices and social equity as consumer awareness rises. This also includes addressing serious issues such as child labor in parts of Africa and Asia, particularly within supply chains for critical minerals, where companies are working to ensure ethical sourcing and protect vulnerable communities.

- Governance and Ethical Practices: The focus on transparency, ethics, and accountability in business operations is intensifying. Companies are increasingly held accountable for their governance structures, with rising expectations for diverse leadership and strong compliance systems that foster ethical behavior throughout the organization. Intel is a prime example of ethical leadership in action. The company has aligned executive compensation with ESG metrics, reinforcing its commitment to corporate responsibility. Additionally, Intel continues to drive diversity within its leadership ranks, strengthening its governance and ensuring that accountability is woven into the fabric of its operations. This proactive approach not only enhances their corporate culture but also sets a high standard for ethical practices in the tech industry.

- Circular Economy Initiatives: Organizations increasingly prioritize recycling, reuse, and sustainable material use to minimize waste and reduce carbon footprints. Patagonia is a prime example of a company leading the charge, continuously using recycled materials such as polyester and nylon in their products and promoting repair and reuse to extend product life. This commitment to a circular economy is a trend and a necessary evolution in business models for long-term sustainability. Patagonia’s focus on reducing waste and promoting responsible consumption is a model for how companies can integrate circular economy principles into their operations.

Impact on Commodities

The shift to green energy and the rapid growth of EVs drive a surge in demand for key minerals like copper, lithium, cobalt, nickel, and rare earth elements. Significant amounts of copper are required for building new power transmission lines that export energy from renewable energy hubs (such as solar and wind) to urban centers. At the same time, the growing EV market relies heavily on lithium, cobalt, and nickel for batteries. As industries ramp up efforts to meet global sustainability targets, the demand for these critical minerals puts pressure on global supply chains to secure enough resources for a greener future.

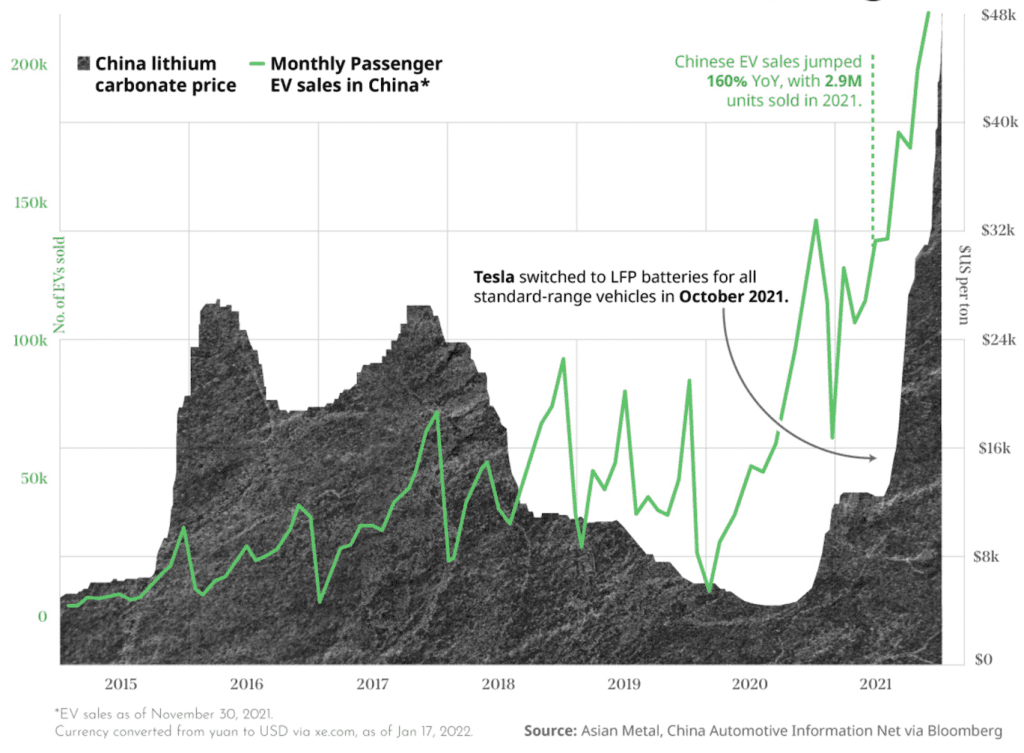

This high demand is expected to lead to a new commodity supercycle—a long period of rising prices driven by shifts in demand. Supply chains may struggle, leading to shortages and slowdowns, further increasing the cost of these essential materials. For example, in 2023, the price of lithium surged due to high demand for EVs in China, the world’s largest EV market.

Chinese automakers expanded production to meet growing demand, causing lithium prices to more than double compared to 2021. In response, major lithium-producing regions like China, Australia, and South America accelerated mining operations, while companies like Tesla secured long-term supply deals to stabilize costs.

Actionable Strategies to Navigate the Commodity Supercycle with Sustainability

As the commodity market evolves, businesses face a unique opportunity to navigate the challenges of a looming supercycle while embedding sustainability into their operations. Here’s how you can position yourself to thrive despite the volatility:

Short-Term Actions (2025)

Implementing these targeted actions in the short term can help companies align with sustainability demands, optimize operations, and foster stronger stakeholder relationships.

Align with ESG Standards

Aligning with ESG standards is essential for companies seeking market credibility and investor interest, especially with the growing demand for green energy minerals. Companies can start by conducting an ESG audit to identify improvement areas, setting measurable goals for reducing carbon emissions, improving worker welfare, and enhancing governance transparency. Engaging stakeholders, including local communities and regulatory bodies, helps secure a responsible supply chain. Additionally, adopting compliance policies aligned with regional requirements supports localized production and reduces import reliance. As regions like the EU and North America push these policies, ESG alignment becomes essential for sustainable growth.

Optimize Supply Chains

Companies should adopt a multi-pronged approach to enhance resilience and transparency in mineral sourcing. Here are three key strategies:

- Implement Digital Tools for Real-Time Monitoring: Use AI-driven analytics, IoT sensors, and digital dashboards to monitor real-time supply chain operations. This helps identify bottlenecks, anticipate disruptions, and make data-informed decisions promptly.

- Enhance Traceability with Blockchain Technology: Blockchain can provide secure, immutable records for every mineral sourcing and processing stage. By tracking each supply chain step, companies can ensure traceability, helping them meet growing sustainability and compliance requirements.

- Diversify Suppliers and Localize Sourcing: To mitigate risks, consider diversifying suppliers across different regions and establishing partnerships closer to key markets. Localization helps reduce dependency on long-distance shipments and strengthens resilience against global disruptions, a lesson reinforced by post-COVID supply chain challenges and recent geopolitical conflicts.

Engage Stakeholders with Sustainability Goals

To engage customers and investors in your sustainability goals, share transparent progress reports to build trust and accountability. Use digital platforms to highlight initiatives like carbon reduction or renewable energy adoption. Certifications such as LEED or ISO 14001 add credibility, while events and webinars foster direct interaction. Partnering with sustainability advocates and creating programs like recycling drives or volunteer days encourage stakeholder participation. These efforts position your brand as a responsible and forward-thinking leader in sustainability.

Long-Term Strategies (2030s)

Invest in Green Infrastructure

Investing in green infrastructure is more than a sustainability goal; it’s a strategic advantage. Businesses should allocate funds to retrofit warehouses, factories, and offices with renewable energy sources like solar panels and wind power. Incorporating energy-efficient utilities such as LED lighting, smart heating, Ventilation, Air Conditioning (HVAC) systems, and energy management tools further reduces operational costs and carbon footprints. Additionally, partnering with local renewable energy providers and supporting local mineral production can ensure a secure and sustainable resource supply while positioning your company as a leader in green innovation. This proactive approach helps businesses stay competitive and meet growing regulatory and market demands for sustainability.

Use AI for Sustainability Insights

Advanced technologies like Artificial Intelligence AI are crucial for managing sustainability performance and staying agile during the supercycle. AI-powered analytics can identify inefficiencies, predict maintenance needs, and optimize supply chains to meet ESG standards. By leveraging AI, businesses can improve sustainability, reduce costs, and meet the growing demand for eco-friendly practices, ensuring competitiveness while advancing their goals.

Forge Strategic Partnerships

Building strategic partnerships is key to thriving in the green economy. Collaborate with renewable energy providers, sustainable material suppliers, or tech innovators to access advanced solutions while sharing costs and risks.

Conclusion: Leveraging Sustainability for Competitive Advantage

The sustainability-driven transformation of global markets and the anticipated commodity supercycle present unparalleled challenges and opportunities for businesses. Companies can create a sustainable future by integrating ESG principles and aligning with green energy trends. The path forward requires strategic investment, innovation, and adaptability.

Silicon Valley Innovation Center’s expert-led programs equip you with the tools to align ESG principles with business growth, navigate the commodity supercycle, and embrace green innovation.

- Strategic Partnerships: Learn to collaborate with renewable energy providers and sustainable suppliers.

- Green Innovation: Explore AI-driven solutions and green infrastructure investments for long-term advantage.

- Actionable Insights: Create a roadmap to thrive in an evolving, sustainability-driven economy.

Join us to shape your organization’s future in the green economy.

Design a custom program tailored to your goals.